Suggestions from The Suggestivist:

For investors: Keep an eye out for the AvidXchange S1, which should be published in the coming weeks. AvidXchange is a B2B accounts payable company that is addressing a large TAM and enjoys strong networks effects. The company competes with Bill.com.

For AvidXchange: Think about improving your software's UI to make sure the product is clean and intuitive. Also, consider investing in R&D and AI to drive new product introductions. In your S1, help investors better understand what is unique about Avid compared to competitors, or frame the AP opportunity as a “rising tide lifts all boats” situation.

It pays to keep good company

Many investors that looked at the Bill.com IPO and passed have likely kicked themselves for it. If you're not familiar with Bill, take a second to pull up the chart – it’s pretty impressive. The company’s success is the result of Bill addressing a key pain point for businesses: it modernizes a clumsy, time consuming, paper-based accounts payable process by moving it into the cloud. With a strong and growing network effect and a large target market, plus the digitization tailwind provided by the pandemic, Bill has proven to be an impressive story to follow. But not everyone loves Bill: Packy McCormick, of Not Boring fame, recently wrote a piece challenging the company's antiquated interface and valuation. The article is definitely worth a read (check it out here) – it also serves as a bit of a primer to this piece.

Anyway, this isn’t a Bill.com writeup. Instead, today I want to write about a private, under-the-radar competitor to Bill: AvidXChange (aka Avid). Like Bill, Avid helps companies move paper, labor-intensive accounts payable processes into the cloud. The company's most recent private market valuation was ~$2B (as of April 2020) – long time backers include payments giants like MasterCard and Peter Thiel, as well as some of the usual suspects, including Bain, Sequoia, and Founders Fund.

Why should you care about Avid? Because, it looks to be coming public soon. And pattern recognition suggests that there is a lot of opportunity for Avid: similar B2B businesses include Bill, as well as other highflyers like Coupa, Paycom, and WorkDay. With an impressive cohort of peers and a solid set of VC backers, will investors that missed the Bill IPO get another bite at the apple? Let’s dig in...

AvidXchange highlights

8yr sales CAGR: 40%

Founded in 2000, led by founder/CEO Mike Praeger

1,500+ employees in seven different offices around the US

Handles over $140B in transactions (more than Bill)

Network of 680k+ suppliers

Over 6k customers

HQ in Charlotte, NC

Background

The accounts payable process at most mid-sized businesses is bewilderingly complex. You'd think the process of buying something from a supplier and paying for it would be relatively straightforward (sort of like paying a credit card bill). Unfortunately, it’s not. The image below shows a normal AP process in a B2B setting.

The twelve steps above require finance controllers to do a lot of heavy lifting. From tracking down paper invoices and receipts, to manually entering information into accounting systems, to figuring out the right way to pay suppliers...I get anxiety just thinking about it. This is why Avid exists: its goal is to simplify the AP process and free up time and resources for more productive activities. It does this via a cloud-based software suite that focuses primarily on automating purchase orders, invoices, and payments between businesses. The image below shows the steps in the AP process that Avid handles electronically, effectively rolling up most of the AP process onto one platform.

A quick way to think about Avid is as a B2B version of some popular payment services. For those of you that process work-related expenses through mobile apps, Avid is sort of like Concur or Expensify, but for a purely B2B setting. A more stretched, but likely more familiar, analogy is that Avid is sort of like Venmo or CashApp for businesses. Sort of.

The largest competitor Avid faces is paper – according to Avid, the majority of US businesses still don't use any automation software. Bill is another competitor, but Bill primarily tackles the long tail of SMBs, while Avid handles companies that are slightly larger. Outside of Bill (and Coupa), an interesting cohort of startups has emerged that aims to provide similar value propositions as Bill and Avid (including a company called Settle).

Business ecosystem

Like most companies that operate some form of payments infrastructure, Avid exists in a complicated ecosystem and connects to a variety of suppliers, customers, and partners through a dense network. To straighten out what exactly the business ecosystem looks like, I’ve created a simplified chart below.

Before analyzing the interactions between these members, I want to highlight the key enabling part of Avid’s value offering: a platform shift. Avid’s platform shift is simple: the business replaces the old AP processes (paper, labor, manual data entry, etc.) by automating them through software. Avid’s AP platform not only enables customers and partners to interact with each other seamlessly, but also builds a foundation for new services (which can be offered by any part of the ecosystem). Most of the successful businesses in the payments landscape in recent years are enabled by a platform shift: companies like Bill, Avid, Coupa, Adyen, Square, and others have all either established new platforms or significantly improved upon older platforms. I’ll admit to a bit of cherry picking in assembling this peer group, but the pattern is clear: reducing friction through payment platforms provides a ton of value to payments ecosystems and has helped newcomers displace incumbents.

Now, let’s take a look at how Avid manages the health of its ecosystem by adding value to each party it interacts with.

Supplier value creation: Avid’s primary suppliers (not including partners) are its employees. I break employees into two groups: sales and support employees, and developer employees.

Sales and support employees: Unlike Twilio, there is no “ask your developer” type adoption scheme at play with Avid. Instead, Avid relies on its sales reps (and partners) to sell into organizations. Once sold, Avid needs to support customers (Avid offers 24/7 support). These two sets of customer-facing employees are crucial in growing and maintaining relationships and therefore must capture their fair share of the value that Avid generates. Anecdotal evidence I've gathered suggests that pay for sales and support employees is decent, but it might not stack up versus some other B2B sales positions, especially in areas like workforce management (WDAY, PAYC). I’m curious to learn more about any bonus structures or other incentive programs that Avid has in place to help accelerate growth and customer satisfaction through its sales and support employees.

Developer employees: I don't have much to say about the value creation for developers – Glassdoor points to six figure salaries, which is fine. Especially in against the backdrop of its location (NC), Avid might be able to win developers who want a different lifestyle than would be offered by many other firms.

Customer value creation: Avid primarily sells to mid-sized enterprises; some recognizable examples include Colliers International and J.G. Wentworth. As these businesses transact with each other on an AP/ AR basis through Avid, a powerful network effect develops. Avid also connects to certain large enterprises, like Verizon and other utility providers. These parties enable common utility payments to be made from mid-sized businesses to suppliers. How does Avid provide value to these customers?

Mid-sized businesses: The value proposition of Avid's software is very clear: it significantly reduces friction in the AP process. This is especially true as the network of customers and partners continues to grow. There are four benefits that exist under the umbrella of “reducing friction:” faster payments (and better cash management as a result, see Packy's quick explanation of this here), a reduction in mistakes thanks to automation rather than doing AP by hand, the ability to reallocate headcount from AP to other, more productive areas, and finally there is a significant financial and time-based ROI (Avid says it cuts AP processing times by 60%). Avid has a slightly different spin on its value creation for customers, as represented in the image below.

Large businesses: In a way, a handful of large businesses are key customers (and partners) for Avid. The enterprises that Avid’s SMB customers do business with most frequently include AT&T, Comcast, Verizon, Duke Energy, Grainger, Sherwin Williams, and Staples. The value-add to these enterprises is that payments from SMBs are easier and faster through Avid. Sometimes Avid refers to these big businesses as suppliers, but I'm going to keep them in the customer category for simplicity.

Partners: Finally, the most interesting part of the ecosystem: partners! Without the four key partners highlighted above (banks, accounting software, VARs, and ISVs), Avid would not exist. One way to think about the role of partners: they all effectively serve as distribution channels that either 1) sell solely for their own benefit (Avid pays them), or 2) plug into Avid and work together to create value for customers, thereby synergistically generating sales. The image below gives Avid’s take on the different groups it partners with. Thanks to the critical role partners play, the value offered to the partner ecosystem is very important to understand.

Banks: Bank partners are arguably the bedrock upon which Avid has built its business, because, at the end of the day, money ends up in the bank. Banks partner with Avid for two reasons. First, Avid can serve as an on-ramp for businesses to find banks to keep deposits with. Second, working with Avid may lower customer churn in that bank (theoretically, a business that wanted to use Avid might switch banks if their existing bank didn’t integrate).

Accounting systems: Avid connects with most major SMB software providers (over 180 of them), including QuickBooks, Sage, Netsuite, Microsoft, and Oracle. These integrations make working from general accounting to doing AP seamless – a big benefit for customers. Accounting system partners integrate with Avid in order to better serve their own customers, mitigate churn, and deepen relationships with customers.

Value-added resellers: The value-added reseller channel (VAR) is one of my favorite sales channels. This is because for any SMB, there is a litany of 3rd party, trusted groups/ individuals (lawyers, accountants, designers) that work closely with said business. I think VARs are the best sales force Avid has, because these trusted advisors already have a close relationship with potential Avid customers. This means sales for Avid can be generated in a much more seamless and frictionless manner: instead of getting a call from an Avid sales rep that you don't know, setting up a meeting, demoing the software, etc...a new customer can be won much faster through influencers (their existing accountants). For reference, Bill has 5,000 accounting firm partners that represented 46% of total revenue for fiscal 2020. Avid rewards its VAR channel directly, by offering financial incentives for sales and recommendations.

Independent software vendors: Avid’s independent software vendor (ISV) channel allows Avid to reach an even broader customer base. I don’t think this channel is super important for Avid. ISVs capture value via incentive payments for sales of Avid software.

Monetization

Now that we understand the value that Avid provides to each party in its ecosystem, it’s time to look at how the company captures value for itself. Avid charges customers two direct fees: first, a subscription fee and second, transaction fees. Beyond that, I suspect that the company makes money on both float and integration costs.

Subscriptions: Avid has a recurring subscription fee associated with its services (dollar amount depends on the client). As a comparison: the corporate version of Bill starts at ~$70/month per user. I suspect that the majority of Avid's sales are linked to its ongoing subscription fee, giving it a nice stream of recurring revenue. This subscription fee scales with the number of users. Additionally, the number of modules, or services, purchased impacts the subscription cost.

Transaction fees: On top of subscription revenue, Avid earns transaction fees for certain services. If the company looks anything like Bill, these fees are likely associated with things like ACH transfers, cross-border transfers, virtual card usage, etc. For Bill, transaction fee revenue has recently surpassed subscription revenue. So maybe Avid makes slightly more money on transaction fees than subscription fees. My guess is that the revenue split is pretty even between the two.

Float: While holding customer funds in trust while payments are clearing, Avid earns short term interest – aka float revenue. Given the current low-rate environment, I doubt Avid is making a lot of money from float. Having said that, traditionally, Bill has made a solid chunk of money on float: 13% of revenue in FY2020. When Avid comes public, I doubt short term interesting income will be a large contributor to recent revenue, but it shouldn't be discounted as a non-contributor, especially as rates rise.

Integration costs: Compared to Bill, Avid's software is significantly more customized to businesses' workflows. This is in large part a result of Avid serving customers upmarket to Bill, meaning there is more work that needs to be done to plug Avid into larger business's more robust software suites. I've read accounts that suggest Avid's integration can take months and cost thousands of dollars.

After reviewing these monetization strategies, I don’t think Avid is capturing an unfair amount of value in the ecosystem. This means there might be some latent pricing power for Avid going forward; however, I think a better growth strategy is continuing to innovate to add value for customers.

Moat

AvidXchange has three important moat sources. Two are positively reinforcing: the company’s network effect and scale advantage. These result in happy customers. One is negatively reinforcing: the switching costs primarily associated with customizing the software to specific customers. This results in sad customers. The image below provides a quick overview of these moat sources, and importantly illustrates how customers feel when experiencing these moat sources.

Network effects: Avid enjoys some strong network effects: the more businesses that use Avid's software, the easier it is to pay suppliers or get paid as a supplier. Like many networks, the incremental value added by more users within an existing “cluster” is not incredibly high, though. Put another way, once an Avid customer has connected with each of its business partners within the ecosystem, new members of the network do not necessarily add value. Importantly, the network effect is a value-generative moat source, rather than one that costs the customer anything. This makes customers happy!

Scale: Avid has significant scale thanks to the large network of partners that it integrates with. There is a slight distinction that is important to make between Avid's network effect moat source and its scale moat source. While the network effect (narrowly defined) is all about connecting businesses with each other, the scale benefit is more about connecting to all the other requisite components in the ecosystem and collecting data from across this landscape. As an example of ecosystem scale: if a competitor were to try to launch a product to compete with Avid, there are significant scale-related barriers to entry not only for gaining customers, but also on connecting to banks, accountants, other software vendors, etc. Those that scale fastest and develop relationships within the ecosystem may be difficult to displace, simply because no one wants to run 100 different integrations. As a result, I imagine that only a handful of these B2B payments companies will turn out to be successful – and this success will, in part, be determined by a first mover advantage (easier to scale with partners). The data collection scale advantage operates in a similar way: first movers have a degree of lock-in as described above, and are able to outrun peers thanks to better product introductions enabled by superior data collection and analysis. Avid's scale moat source is somewhat positively reinforcing and leads to happy customers (helps with things like better AI products).

Switching costs: Customers that adopt Avid have relatively high switching costs. Contracts and pricing are bespoke and integrations with existing software takes some time (months). Once live, Avid’s integrations represent a barrier to picking a different software providers, as ripping and replacing Avid would be time consuming and potentially costly (high cost of failure, low payoff). Unfortunately, switching costs represent a negative moat source. However, so long as customers are happy with Avid, then there isn't a problem.

To sum up, Avid’s network effect and scale positive moat sources that are value-generative for customers. These effectively act as "flywheels" (ugh) that are positively moat reinforcing. The switching costs moat source Avid enjoys is largely a negative to customers – if unsatisfied with the product, customers will have a difficult time replacing Avid and come to dislike the product even more.

Growth

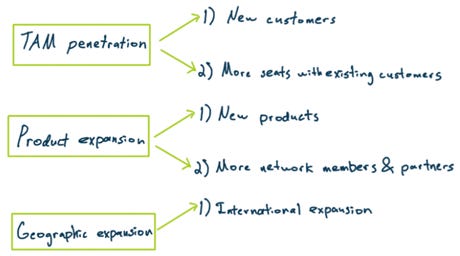

According to CEO Mike Praeger, Avid has grown topline at a 40% CAGR over the last eight years. Even with this growth, there remains an immense runway to continue automating the AP process. Avid can also grow via new product introductions, thereby increasing the ARPU of each customer. Finally, in the long run, the business may also launch in geographies outside the US, representing another massive opportunity. Detail on these growth drivers is provided below.

TAM penetration: Avid’s TAM is very large and the company has a ton of room to continue to replace legacy AP processes. I’ll give a couple of examples that help frame the opportunity. First, at the start of 2020, over 60% of payments made by SMBs were done via paper check. Second, consider that 40% of businesses use “automation software,” but apparently that includes legacy technology like scanning. Less than 20% of businesses have full automation. Finally, a data point that Praeger has shared in the past: the middle market TAM in US alone is 415k companies between 5M-1B revs (Avid's core market). Avid is the industry leader in the middle market and only serves 6k out of those 415k customers. Continuing to win this business takes time, as industries slowly adopt new technologies. To this point: changes to the accounting process within SMBs sometimes move at the speed of science: one funeral at a time. While that is obviously slight exaggeration, in a recent podcast, CEO Mike Praeger shared an anecdote that wasn't dissimilar. Describing how slow adoption can be, Praeger tells the story of a call he got from a prospect that he pitched 10 years earlier. Blown away that the prospect still remembered Avid, Praeger asked why he decided to automate AP after so long. The prospect said that the previous controller had retired after 32 years, and that the new, young, millennial, "whippersnapper" controller wanted to eliminate paper checks. As more digitally-native employees enter the workforce and shed paper-based systems, Avid is well positioned to continue to grow for years to come.

Product expansion: Avid has the opportunity to introduce more products on top of its core AP platform. Some recent examples include integrating virtual cards and a product called invoice accelerator. I have a couple of pretty out-there ideas for new product introductions for Avid: Avid could do more in procurement, like Coupa, and build a platform within Avid for suppliers to list and sell products. Or, maybe Avid could be more like Square and offer some sort of financing to customers. New product introductions not only drive ARPU (through increased subscription or transaction costs), but also increase switching costs for customers (in a good way – through higher satisfaction). New products also increase Avid’s scale advantage thanks to increased data collection. To accelerate new product introductions, I think Avid should be more active in building and/or acquiring expertise in data collection, cleaning, and AI.

Geographic expansion: Avid does not appear to have any immediate plans to expand outside the US. In fact, the only language Avid currently supports is English. There is a massive opportunity in the international AP space for Avid to pursue – I know Bill has international expansion in their growth plans. Building an ex-US presence might not be terribly difficult, given that some existing Avid customers likely operating in multiple countries. Additionally, I assume some of the existing software integrations (e.g. QuickBooks) might provide an easy on-ramp for international companies.

Leadership & culture

Avid is led by CEO Mike Praeger. He co-founded the company in 2000 with David Miller (who now sits on the board) and has been running it ever since. Mike has an entrepreneurial background: while in college, he started a painting business that ended up employing over 200 people. This, plus later experiences at Summit Partners and a handful of subsequent startups led him to start Avid. One characteristic that I like about Praeger as a leader is his focus on the customer. In interviews, he has said that (paraphrasing) when entrepreneurs ask him for advice, he tells them unless they can clearly articulate what the value they are providing their customer is, then they don't know what business they are actually in. This is particularly important for Avid, given that feedback and data from customers help drive Avid's innovation and growth.

In order to better understand Avid's culture beyond Praeger, I'm using a framework that I've lifted from an AKO Capital white paper (available here). Specifically, I'm using the six dimensions outlined on page eight. Actually, I'm only using numbers 1-4, because as a private company I have little insight into Avid's planning and transparency (numbers 5 and 6).

Adaptability: I think Avid has a reasonable degree of adaptability. Praeger's background working in PE and as a 5x entrepreneur suggests that he has a good understanding of both the startup ecosystem and how to run and scale a business. An interesting anecdote that supports the idea that Avid is adaptable: Praeger has said that every 90 days, the entire Avid senior leadership team takes two days off to zoom out of the business for a while and approach it with a fresh perspective. This strikes me as a clever strategy that helps prevent the management team from getting stuck in the weeds. To this point, Praeger said that most of the breakthrough moments in Avid's history have come from these two-day retreats. Avid also describes its culture and business as one that is a "work in progress." This mindset should bode well for the business as it continues to evolve.

Customer focus: Avid appears to have a strong focus on the customer. I suspect that this leads to better adaptability, as Avid should be able to respond to changing customer demands faster than peers that have less of a focus on the customer. Additionally, Avid has a very strong NPS score, at 78 (according to this website). In all likelihood, Praeger's focus on the customer goes well beyond his role as CEO, and I suspect that is a core part of the entire organization's culture, from employees in developer roles to customer support roles.

Employee focus: Honestly, I don't have a good read on how focused Avid is on its employees. I do know the company runs a foundation, called the "AvidXchange Foundation," which is dedicated to "making a difference in the lives of young people where we work and live.” Glassdoor reviews from employees are also solid.

Governance: There is not exactly a proxy to go through for Avid. However, there are a couple of other indicators that I think support the idea that Avid has good governance. First and foremost is that Avid is founder-led (I know, I know... everyone loves a good founder-led business). Beyond that, the company has one woman on its board (10%). 23% of the executive team is female and 30% of the senior leadership team is female. The image below gives a look at diversity within Avid's entire workforce.

Risks

I see three primary risks to Avid.

AP competition: businesses like Coupa, Tipalti, Bill, and Medius are the other leaders in the SaaS AP space, besides Avid. Each of these offers some unique spin on B2B payments. Eventually, I suspect that there will be some consolidation here, but in the medium term that might be a bit of a land-grab battle. Beyond these more established players, there is a healthy group of startups tackling the same opportunity. Two that come to mind are Settle and Melio.

Other competition: I'm curious if other parties within Avid's ecosystem could successfully launch a competing product. For example, I could see Intuit ringing AP payments in-house and offering it as an add-on to QuickBooks. Another potential threat: could Square easily launch a similar service for vendors that use its POS and other services?

Technical debt: This seemed to be one of Packy's biggest frustrations with Bill: he thinks it has a lousy UI and that the software is a bit clunky. Avid is basically as old as Bill, so I'm worried that Avid might also have some technical debt. I've compared screenshots and YouTube videos between Bill and Avid and don't see a massive difference between the two user interfaces.

Conclusion

There is a lot to like about Avid. The business generates value for a large number of players in a complex ecosystem, monetizes in a non-abusive manner, has a solid moat, and is still in the early innings of addressing the massive TAM within the AP space. Plus, CEO Mike Praeger appears to be a good leader who has established a healthy organizational culture with an intense customer focus.

I'm excited to see Avid's S1 when it does finally come out – it should give investors a much better apples-to-apples comparison vs. Bill. Until then, I hope this primer was helpful. If you have any feedback or input, please email or DM me. And keep an eye out for the S1 update!

Disclaimer: The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.